The new rules will probably affect your finances.

In the U.S., virtually all of the income you earn is subject to federal income tax. There are specific rules you need to follow regarding how much you pay, as well as the deductions that you are allowed to claim.

The IRS recently announced some changes to the tax rules for 2026, and those changes could affect how much you end up paying. Since these changes are for the 2026 tax year, they will be in effect for income you earn starting in January of 2026 and will affect the tax return that you file in April of 2027.

Here’s what you need to know about two of the big changes that will impact your finances in the 2026 tax filing year.

1. Tax brackets are changing

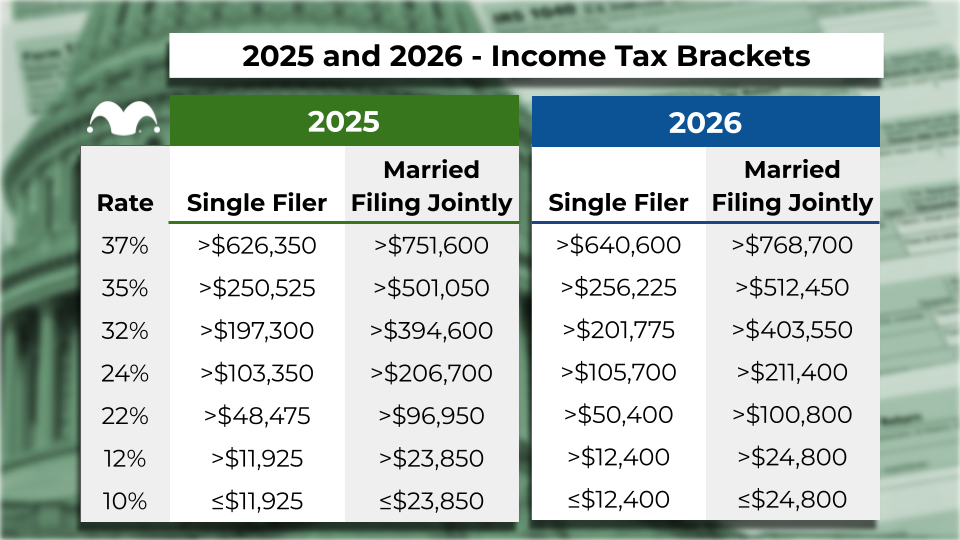

The first change that is taking place relates to the tax brackets. As the tables below show, the income ranges within each tax bracket are changing.

Tax brackets exist in the U.S. because we have a progressive income tax system. You do not pay the same tax rate on all of the income that you earn. Tax brackets set the rates that you will pay at different income ranges.

For example, everyone — no matter how much they earn — pays 10% on the first $11,925 in earnings they have in 2025. And in 2026, everyone will have a little more of their income taxed at that ultra-low tax rate since they won’t move up to the 12% bracket unless they have earned more than $12,400.

With these changes to the tax brackets, the taxes that most people pay should decline because they can now earn more income before moving up to the next tax bracket and paying a higher rate.

2. The standard deduction is changing

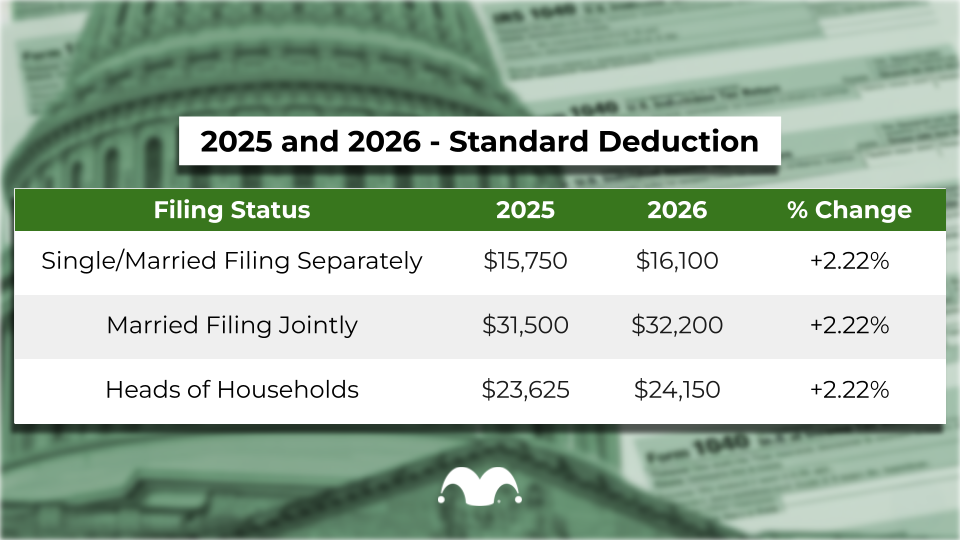

There’s another big change coming for the 2026 tax filing year. As the table below shows, this change is to the standard deduction.

Image source: The Motley Fool.

The majority of tax filers claim the standard deduction, which means they can subtract this set amount from their taxable income when determining how much they owe.

For example, if you make $45,000 a year, you are not taxed on $45,000. You can subtract the amount of the standard deduction from this amount. If you are a single filer or married filing separately, this would mean you could subtract $15,750 in 2025 and $16,100 in 2026. So, you would be taxed on $29,250 in income in the 2025 tax year and on $28,900 in 2026.

Not everyone claims the standard deduction because some people opt to itemize deductions on their return. Itemizing means claiming deductions for specific things like mortgage interest and charitable contributions.

It only makes sense to itemize if the value of your itemized deductions adds up to more than the standard deduction — which is not the case for most people. And, as the standard deduction increases, itemizing makes sense for fewer and fewer people.

How will these changes affect your taxes in 2026?

With a higher standard deduction and income thresholds to move into higher tax brackets increasing, your tax bill should go down in 2026.

You will pay tax on less income due to being able to deduct 2.22% more money, and more of your income will be taxed at lower rates since it takes more income to move up to a higher bracket.

This makes sense, since tax brackets increase each year because of inflation. Each dollar you earn buys less every year as prices rise, so if the tax brackets never changed, taxpayers would be pushed into higher brackets without a real increase in earning power.

Other tax changes will take effect in 2026, thanks to the Big Beautiful Bill, including an added deduction for seniors. All of this means that many people should expect their federal income tax bill to look very different for the 2026 tax year.

#Big #Income #Taxes #Coming #Tax #Filing #Year